A report by professional services firm PricewaterhouseCoopers (PWC) indicates that insurance premiums across Africa are set to go up by up to 3 per cent in 2018. The growth is attributed to the growing middle class with an increased disposable income. Higher yield especially from bonds are also expected to increase profitability in the insurance sector.

Change in asset allocation for instance infrastructure debt, real estate and market corporate loans have also been cited as a course for the increase, as well as the rising commodity prices which is expected to accelerate economic growth.

‘’As the economy starts to improve the key growth opportunities lie in the agriculture and infrastructure for the non-living insures,’’ the report reads.

The report also indicates that weak economic conditions including pessimistic level of business and consumer confidence have slowed demand for infrastructure and spending generally.

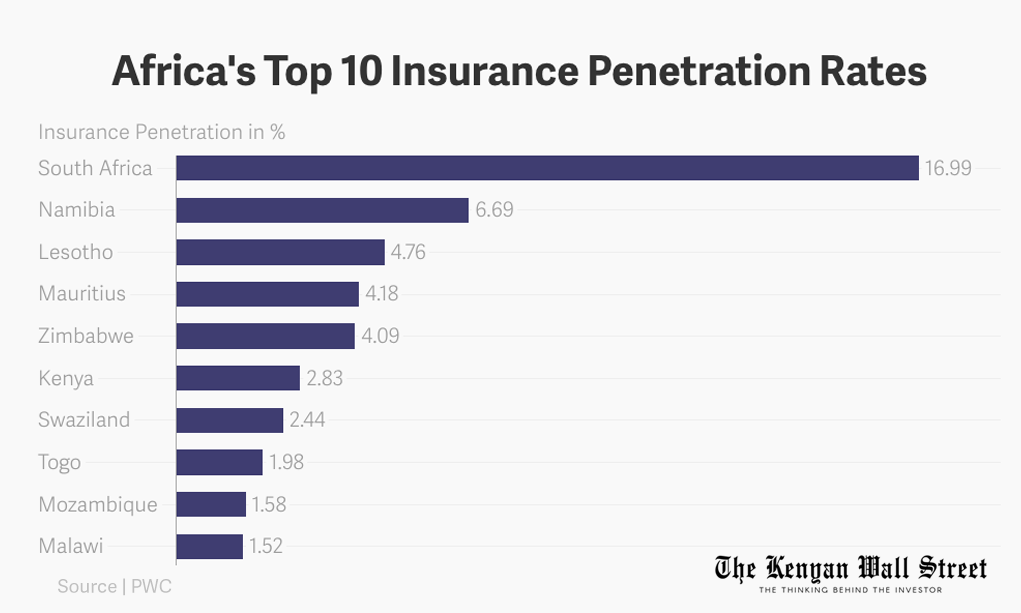

However despite these concerns, insurance penetration continues to grow in most African countries with South Africa leading at 16.99 per cent. Kenyan insurance uptake is still wanting at only 2.83 per cent despite leading her East African counterpart Uganda and Tanzania at 0.77 per cent and 0.68 per cent respectively.

Life insurance remains higher in most African countries Kenya included at 41 per cent to no life insurance at only 20 per cent as of 2016.

According to the association of Kenya insurers report of 2017, ‘’Global premiums in non-life reinsurance are estimated to have grown by 3 per cent in 2017 in real terms, based on rapidly increasing cessions from emerging markets. In 2018, advanced markets non-life reinsurance premium growth will reflect a hardening of rates and slightly stronger nominal growth in the primary market.’’

The report continues to show optimism in the sector with insurance premiums expected to grow much faster between 2017 and 2020

‘’Insurers across all Africa will need to find innovative and cost efficient ways to increase penetration into the largely under insured markets,’’ the report reads.

The insurance sector still remains harsh to new player who fight to remain afloat. In most African countries up to 58 per cent of the insurance business is taken by already established broad based financial institutions and the niche players, while the other 42 per cent being among start- up, financial institutions moving from one market to the other and foreign insurers entering the market all at 14 per cent.

Old dependency.

With the current median age of Kenya being only 19 years, the report shows that Old-age dependency is a crucial concern in developed economies, as it challenges established retirement systems and pension contributions as well as labour markets. But this issue is, and will remain, less of a concern in Africa, as the old-age dependency ratio of the continent will be by far the lowest in the world.

‘’More specifically, by 2050, there will be ten people between the ages of 15 and 65 years for every person aged 65 or over. Overall, the continent will enjoy a large population of working-age citizens in the future. Such an increase in labour supply is generally seen as a demographic dividend to GDP growth through increased savings, investments, innovation, and labour efficiency. This demographic effect could add nearly 0.5 percentage points to GDP per capita growth over the next 15 years.’’ It read.

- Kenyan Wallstreet

-featured.jpg)