Financial Sector Deepening (FSD) Kenya conducted a study on the digital credit revolution in Kenya in partnership with CBK, KNBS, and Consultative Group to Assist the Poor (CGAP). The study comes at a time when the digital credit market in Kenya is growing rapidly as mobile penetration increases. For instance, M-Shwari disbursed Sh230 billion since it was launched in 2012 while KCB offers 90 percent of its loans via KCB M-Pesa. Additionally, Equity bank has disbursed Sh57 billion via Equity Eazzy since 2014.

The study, which was carried out in mid-2017, shows that 27 percent Kenyans (~23.5 million adults) borrow digitally with about 17 percent having borrowed digitally within the last 90 days. Additionally, the survey discovered that 51 percent of Kenyans who own a phone but have never borrowed digitally.

Leaders in the Digital Credit Market in Kenya

The Kenyan digital credit market is led by CBA’s M-Shwari followed by KCB’s M-Pesa, Equity Eazzy, Tala, and MCoop Cash in that order.

During the survey, the number of people that had current loans was 14 percent with CBA’s M-Shwari, 5.7 percent with KCB M-Pesa, 1.2 percent with Equity Eazzy, 0.9 percent with Tala, and 0.4 percent with MCoop Cash.

According to the survey, 35 percent of Kenyans with phones have tried at least one digital lender. At the time of the survey, 14 percent of digital borrowers were repaying multiple digital loans.

Demographics of Digital Borrowers

FSD’s survey indicates that digital borrowers are likely to be male, young, and more educated. Additionally, they are more likely to be running their own businesses or employed.

The major reason why others do not borrow digitally is the fear of taking loans. The other reasons are; unawareness, unqualified for loans, too expensive, lack of income, and a complex interface in that order.

On the other hand, 37 percent of Kenyans who borrow digitally do so for business purposes. Other reasons for digital borrowing are day-to-day needs, education, airtime, paying bills, personal or household needs, and medical emergencies.

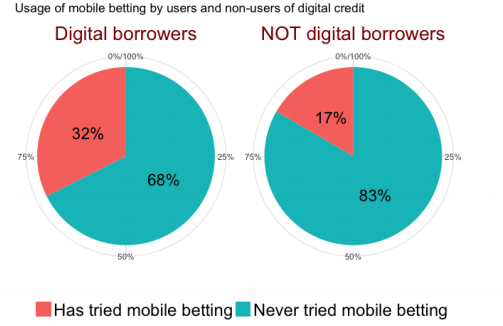

According to the survey, 3 percent of the digital borrowers use the loans they obtain for betting purposes. “On the flip side, digital borrowers are almost twice as likely to have tried mobile betting at least once in their life.”

Entrepreneurs and farmers borrow digitally to fund their businesses while employees and casual workers borrow digitally to finance day-to-day needs.

Young digital borrowers below 25 years mainly borrow to fund day-to-day needs while the main digital borrowing age group (26-35) borrows for business purposes and day-to-day needs.

“Borrowing for business purposes increases with age, however, only 6 percent of digital borrowers are over 55 years,” Edoardo Totolo, FSD Kenya states.

Risks Emerging From Digital Credit Use

About half of the digital borrowers reported having been late in repaying a digital loan. Late loan repayment is more common among men at 49 percent than women at 45 percent.

Poor business performance is the main reason for late loan repayment at over 20 percent while losing the source of income comes second.

The challenges one in every digital borrower faces are short repayment period, cost, difficulty in repaying, and lack of transparency in terms of repayment fees and T&Cs.

19 percent of digital borrowers reported being charged fees they did not expect, not understanding the costs and fees attached to the loan, and lender unexpectedly withdrawing from the account.

Interestingly, 26 percent of digital borrowers did not report any negative experience in digital borrowing.

Furthermore, only 10 percent of digital borrowers have reached out to the lender’s customer care services. 39 percent digital borrowers contact call centres while 37 percent visit the customer care location of the loan provider.

The Portfolio of Digital Borrowers

Digital borrowers are more likely to have medical insurance (NHIF), NSSF, and bank accounts. Moreover, digital borrowers are likely to have bank loans than non-borrowers.

“Overall, digital borrowers seem to use slightly more financial services and have more diversified financial portfolios compared to non-borrowers. [Additionally,] usage of informal credit does not vary much between digital borrowers and those who do not borrow from their phone. This suggests that digital credit could complement rather than substitute other sources of credit,” Totolo says.

While digital credit represents a huge step forward towards formal financial inclusion, a lot still needs to be done in comprehending the real social and economic impact of digital credit on low-income Kenyans. Furthermore, it is unclear whether digital borrowers with positive credit histories graduate to bigger and more reasonably priced loans.

Regulation is also a reason for concern in the digital credit market where the last two years saw the registration of new entrants into the market who were unregulated. Therefore, an oversight body should be created to develop regulations for this market.

“Better tools need to be developed to track over-indebtedness and multiple borrowing. Many borrowers report cutting on consumption to repay the loans, and many report dipping into their savings. Providers should be encouraged to improve their submission and use of data from credit reference bureaus,” Totolo concludes.

- KWS

-featured.jpg)