- Robust laws fail to curb $1.6bn annual illicit financial flows.

- Informal retail thrives despite tax reforms targeting smuggled goods.

- Political elites implicated in gold smuggling weaken enforcement efforts.

By Tendai Sahondo

Zimbabwe is facing challenges in tackling Illicit Financial Flows (IFFs) despite a robust regime of laws aimed at combatting the vice.

According to the International Journal of World Policy and Development Studies, Zimbabwe lost over US$32.179 billion during the period 2000 to 2020 . The paper by Jeffrey Kurebwa further notes that IFFs are mainly driven by the desire to hide wealth and evade taxes. Furthermore, according to a policy brief by Brooking institute, between 1980 and 2018, Zimbabwe's IFFs amounted to 13.9% of total trade.

In an Interview with Humanitarian Eye, Financial Intelligence Unit (FIU) Director, Oliver Chiperesa said one of the major conduits of IFFs is money laundering, which the country has struggled to contain over the years, particularly on the illicit gold front.

"We identified several high-risk areas in our periodic assessment; top on the list are tax evasion, corruption, illicit gold trade and precious metals as well as smuggling. There is a lot of laundering happening in those areas and we have not done enough yet," he admitted.

Chiperesa said the country is yet to reap the full rewards of a compliant legal framework owing to lax implementation, knowledge gap among enforcing agencies and allied factors.

“It is one thing to have a compliant legal framework and it is another thing to make sure the regime is being used effectively to fight money laundering,” said Chiperesa in an exclusive interview.

“I will be the first to admit that we are not being effective in the use of the available laws and the institutional framework to combat money laundering. We are still far from achieving the level of effectiveness as prescribed by international standards,” he added.

However, failure to combat IFFs has devastating ripple effects from a socio-economic point of view. According to the Global Financial Integrity, IFFs result in a loss of what are often desperately needed resources to fund public initiatives or critical investments. Critical investments could include developing the country’s health sector which is currently on its knees or availing water to end the perennial outbreaks of waterborne diseases. Funds lost through IFFs could also be used to develop critical social infrastructure such as schools and roads.

Legislative Framework

Zimbabwe has a relatively healthy regulatory framework when it comes to combatting IFFs. The Money Laundering and Proceeds of Crime Amendment Act of 2018, criminalises Money Laundering and authorises the seizure of criminal proceeds and assets.

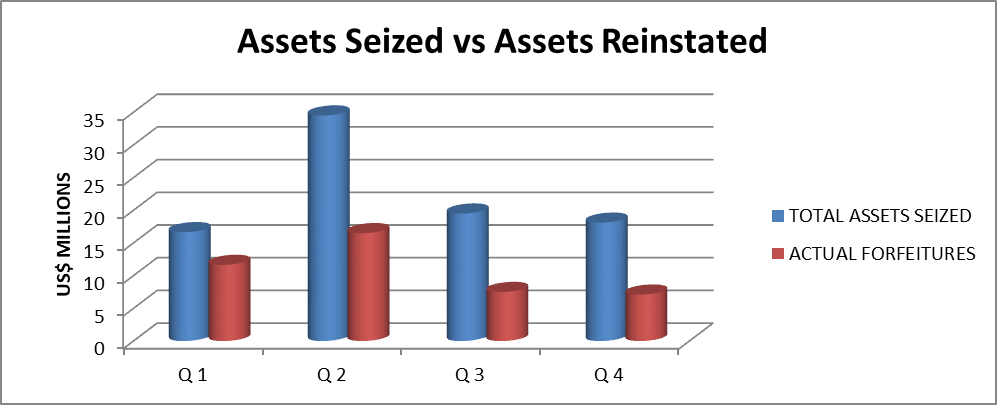

In an interview, Chief Prosecutor in charge of the Asset Financial Unit, (AFU) Chris Mutangadura said the body seized significant ill-gotten assets over the past year, amounting to US$88.7mln, however, only US$42.65mln of the assets were seized and conclusively reinstated as the rest were withheld for investigative and preservation purposes.

The US$42.65mln seized last year is dwarfed by the estimated US$1.6bln lost annually through IFFs. Mutangadura did not respond to questions on challenges that the unit is facing in tracking, seizing and reinstating assets accumulated from IFFs. However activists have blamed government for influencing the judiciary into adopting a catch and release modus oparandi, resulting in well-connected perpetrators walking Scott-free and reclaiming seized assets.

To mitigate against IFFs in the mining sector, Zimbabwe has also enacted laws such as the Gold Trade Act and the Precious Stones Act .

The Gold Trade Act specifically states that "no person shall, either as principal or agent, deal in or possess gold, unless he is the holder of a license or permit; or he is a holder or tributor; or he is the holder of an authority, grant or permit issued under the Mines and Minerals Act [Chapter 21:05] authorizing him to work an alluvial gold deposits." The act imposes penalties of not more than 5 years or a fine of twice the value of the gold possessed by the perpetrator. The precious stones trade act also imposes similar penalties with an addition of steep fines.

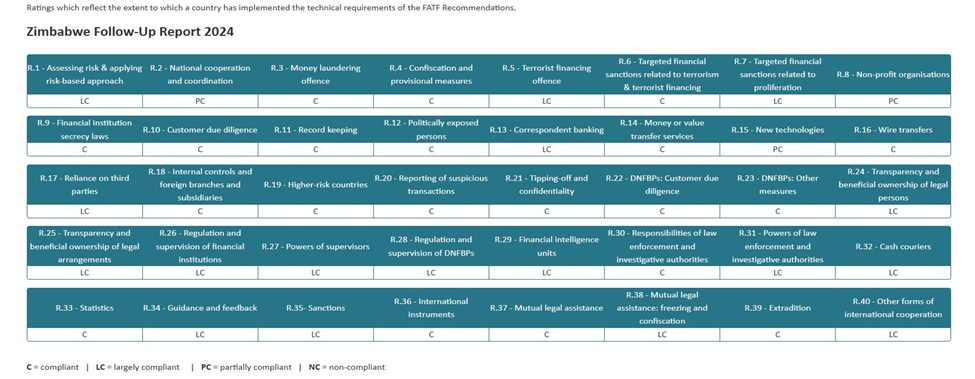

Internationally, Zimbabwe is also considered highly compliant by the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG). In the most recent review done in 2024, Zimbabwe was found to be largely compliant with Financial Action Task Force (FAFT) across the board..

Figure 1: ESAAMLG review showing impressive ratings for Zimbabwe

Leaky retail sector

Zimbabwe has also been struggling to contain IFFs in the retail space with waves of informality sweeping across the sector. Informal traders are now dominating as they capitalise on selling smuggled goods that are priced much lower than one would buy in a registered supermarket.

"The retail sector is suffering from a shrinking market share due to increased informality which has severely affected retail businesses. The closure of several retail and wholesale chains reflects the harsh operating environment characterized by the rapid expansion of the informal economy," said Denford Mutashu, President of the Confederation of Zimbabwe Retailers (CZR).

Solutions

Chiperesa said Zimbabwe needs to bolster its fight against IFFs by prosecuting more cases and seizing more tainted assets.

In addressing lax implementation, Chiperesa said Zimbabwe is currently building the requisite capacity among government institutions and enforcing agencies. Agencies currently being capacitated to combat IFFs and Anti Money Laundering include law enforcement departments, regulatory bodies, the registry of companies, bankers, lawyers, the judiciary as well as precious stones and precious metal dealers.

He said the FIU has engaged various foreign partners to assist in the capacity building exercise such as the World Bank, the European Union, UK treasury and the United Nations Office on Drugs and Crime (UNODC). Zimbabwe has also engaged the Federal Service for Financial Monitoring of the Russian Federation (ROSFINMONITORING), hinged on good relations between the two nations.

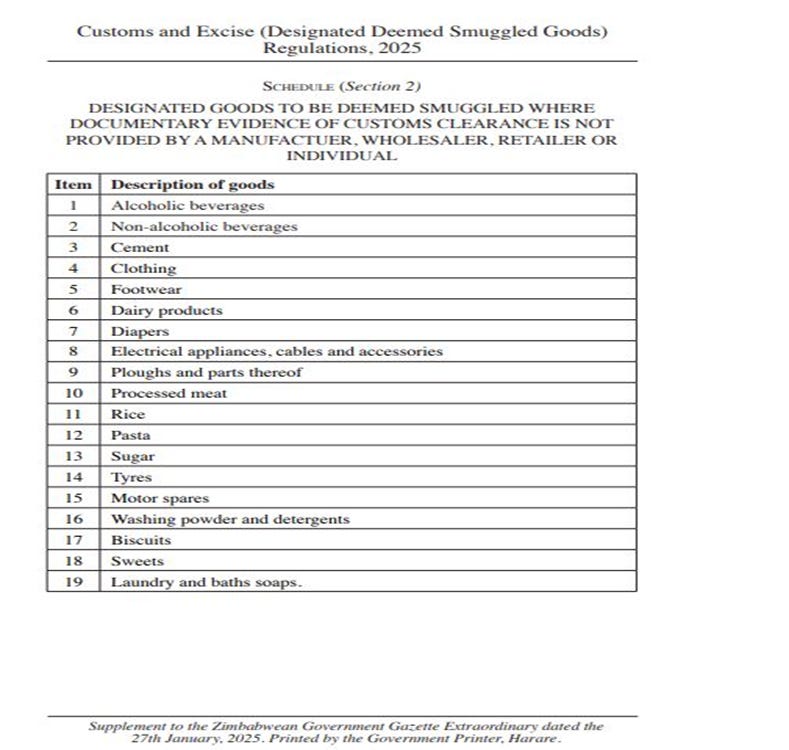

In combatting IFFs in the retail sector, the Zimbabwe Revenue Authority (ZIMRA) has been rolling out an inter-agency blitz that has resulted in the seizure of goods worth $2,4mln with a duty value of US$1,8mln. ZIMRA has gone after cross-border buses, trucks and retailers, demanding proof that goods in their possession were appropriately imported with duty paid in full. The operation has enjoyed the full backing of government with finance minister, Mthuli Ncube enacting a new law that designates certain goods as smuggled in the absence of a tax receipt.

Christened ‘Customs and Excise (Designated Deemed Smuggled Goods) Regulations, 2025, SI 7 of 2025 which was enacted at the end of January has been used viciously to track down smuggled goods by ZIMRA.

The act stipulates that “every manufacturer, wholesaler, retailer or individual who is found in possession of the designated goods, and fails to furnish the Commissioner or any officer or person authorised by the Commissioner, authentic documentary evidence that duty has been properly accounted for in terms of this Act, shall be deemed to have smuggled the goods and liable to payment of the duty thereof, including applicable penalties.

The designated goods that include alcohol, diapers, motor spares and food stuffs form a significant portion of goods sold by informal retailers.

Figure 2: Designated goods under SI 7 of 2025

ZIMRA Chairperson, Regina Chinamasa said the blitz is aimed at addressing risks associated with smuggling of goods which are a threat to legitimate trade, economic development and public safety.

Government has also made it mandatory for all retailers to adopt point of sale machines with the aim of improving tax compliance and formalisation of the economy. However Mutashu says government also needs to introduce lower taxes for the Small to Medium retailers so as to encourage compliance.

"While POS adoption is an important step, formalising the economy requires a more comprehensive approach. The rapid growth of the informal sector remains a pressing concern, as an increasing number of businesses operate outside the tax net, creating unfair competition for compliant retailers and wholesalers.

"CZR proposes the introduction of a Simplified Tax Model based on a tiered system that aligns tax obligations with business size and turnover. This model would allow small informal businesses to gradually integrate into the formal economy through a structured tax framework with lower entry barriers. Such an approach would incentivize compliance while ensuring a broader tax base, ultimately benefiting government revenue collection without overburdening smaller enterprises," he said.

Mutashu said the high cost of digital transactions remains a critical barrier to widespread adoption of POS machines.

"Many businesses, particularly SMEs and informal traders, struggle with excessive transaction fees, high bank charges and maintenance costs for POS systems. If not addressed, these financial constraints could discourage compliance and hinder the effectiveness of the initiative.

"CZR, therefore, urges the government to collaborate with financial institutions to significantly reduce digital transaction costs possibly by 50%, including lower merchant fees and subsidized POS acquisition programs for small businesses," he said.

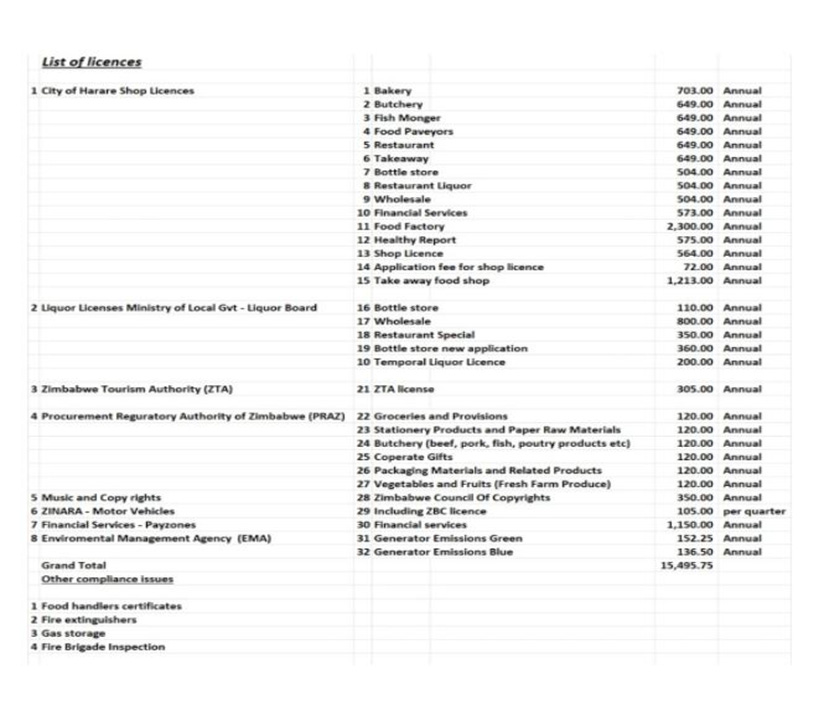

He also decried the steep price of doing business in the country as any retailer has to be compliant with over 30 licensing bodies, placing an extra financial burden on formal trade and consequently discouraging formalisation of the economy.

Figure 3: List of licenses required for Zimbabwean retail outlets

Licenses required for Zimbabwean retail outlets

Lack of political will

However, Centre for Natural Resource Governance (CNRG) Executive Director, Farai Maguwu decried the deficiency of political will to curtail IFFs as politicians are feeding from the same trough to fatten their pockets.

“It has become clear that gold smuggling is a way of life and avenue to wealth, it is not a crime as dictated in the Gold Trade Act and the Precious Stones Trade Act. There is a deliberate effort to protect criminals involved in gold smuggling and money laundering. Of course, the government will say we are smuggling gold as a way of evading sanctions, however, the former governor John Mangudya made it clear that our gold is not sanctioned. This points to systematic organised crime that cuts across the political and military divide,” he said in an interview.

Top government officials were recently implicated in an Al Jazeera expose’, showing how close associates and proxies were being used to facilitate the illicit trade of gold and other metals. Close associates to top politicians such as Eubert Angel, Zimbabwe’s Special Presidential Envoy and Ambassador at Large, clearly detailed how he could use his status to launder money in the country through gold smuggling. The documentary also showed how a web of shelf companies, fake invoices and corrupt officials were utilized to smuggle gold out of Zimbabwe.

The project received support from the Thomson Reuters Foundation as part of its global work aiming to strengthen free, fair and informed societies. Any financial assistance or support provided to the journalist has no editorial influence. The content of this article belongs solely to the author and is not endorsed by or associated with the Thomson Reuters Foundation, Thomson Reuters, Reuters, nor any other affiliates.

-featured.jpg)